Key Takeaways

• Market Warning Signs Demand Defensive Action: The S&P 500 has crossed the “line of death” indicator, with extreme valuations and market conditions similar to previous bubble periods, suggesting a significant correction may occur within 12-24 months – making downside protection crucial for retirees who cannot afford major losses.

• Annuities Provide Essential Retirement Protection: Unlike traditional investments, annuities offer principal protection, guaranteed lifetime income streams, and the ability to participate in market gains while avoiding losses, making them particularly valuable for managing sequence of returns risk that can devastate retirement savings.

• Current Environment Favors Annuity Allocation: Rising interest rates have improved annuity payouts by 20-30% compared to 2020-2021, while market warning signs suggest defensive positioning is prudent – making now an optimal time to consider allocating 20-60% of retirement assets to various annuity strategies based on individual risk tolerance.

• Strategic Implementation Beats All-or-Nothing Approach: Rather than avoiding annuities entirely or going all-in, successful retirement planning involves using annuities as one component of a diversified strategy, with options like dollar-cost averaging, laddering, and hybrid approaches allowing retirees to create a foundation of guaranteed income while maintaining growth potential with remaining assets.

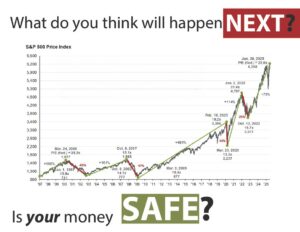

The stock market’s relentless climb has many investors feeling euphoric, but seasoned market watchers are sounding alarm bells. According to recent analysis by Smead Capital Management, the S&P 500 has crossed what they call the “line of death” – a technical indicator that has historically preceded significant market corrections. With the market trading at levels reminiscent of the dot-com bubble, smart investors are asking a critical question: How can I protect my retirement savings from the inevitable downturn?

The answer may lie in a financial instrument that’s often overlooked but increasingly relevant in today’s volatile environment: annuities. As we’ll explore, annuities offer unique protection against market downturns while still allowing for growth potential – making them an essential consideration for anyone concerned about preserving their retirement nest egg.

Understanding the “Line of Death” and Its Implications

The “line of death” indicator referenced in recent market analysis represents a technical threshold where stock valuations become dangerously disconnected from underlying economic fundamentals. When markets cross this line, history suggests that significant corrections often follow within 12-24 months. The current market environment shares troubling similarities with previous bubble periods:

- Extreme Valuations: The S&P 500’s price-to-earnings ratio has reached levels seen only during the most speculative periods in market history

- Widespread Euphoria: Retail investor participation has surged, with many new investors displaying classic signs of bubble mentality

- Concentration Risk: A handful of mega-cap technology stocks are driving the majority of market gains, creating dangerous concentration risk

- Disconnect from Reality: Stock prices are rising despite concerns about inflation, interest rates, and economic growth

For retirees and pre-retirees, this environment presents a particularly acute challenge. Unlike younger investors who have decades to recover from market downturns, those approaching or in retirement cannot afford to lose 30-50% of their savings and wait years for recovery.

The Retirement Risk Dilemma: Sequence of Returns

One of the most dangerous risks facing retirees is the sequence of returns risk – the possibility that poor investment returns early in retirement can permanently damage your financial security, even if markets eventually recover. Consider this scenario:

Retiree A experiences strong market returns in their first five years of retirement, followed by poor returns later. Retiree B experiences the exact same returns but in reverse order – poor returns first, then strong returns later. Despite identical average returns over the period, Retiree B will likely run out of money years before Retiree A.

This is because Retiree B is forced to sell investments at depressed prices to fund living expenses, locking in losses and reducing the capital base available for future growth. With the market potentially approaching a significant correction, millions of current and near-retirees could find themselves in Retiree B’s unfortunate position.

How Annuities Provide Downside Protection

Annuities offer several unique features that can protect retirement savings from market volatility:

Principal Protection

Most annuities provide some form of principal protection, meaning your initial investment cannot be lost due to market downturns. This feature alone can provide tremendous peace of mind for retirees who cannot afford to see their nest egg decimated by a market crash.

Guaranteed Income Streams

Many annuities can be structured to provide guaranteed income for life, regardless of market performance. This creates a “pension-like” income stream that continues even if markets experience prolonged downturns. For a retiree with $500,000 in savings, converting a portion to an immediate annuity might generate $2,500-$3,000 monthly for life – income that continues regardless of whether the S&P 500 falls 50%.

Market Participation with Downside Protection

Fixed indexed annuities (FIAs) offer a compelling middle ground between safety and growth. These products:

- Protect your principal from market losses (0% floor)

- Allow participation in market gains up to a cap (typically 4-8% annually)

- Reset annually, locking in gains and preventing future losses

During the 2008 financial crisis, while the S&P 500 fell 37%, investors in quality fixed indexed annuities experienced 0% losses while maintaining their previous years’ gains.

Why Now Is the Optimal Time for Annuity Allocation

Several factors make the current environment particularly favorable for annuity investments:

Rising Interest Rate Environment

Annuity payouts are directly tied to interest rates. After years of historically low rates, the recent rise in interest rates has significantly improved annuity crediting rates and payout options. A 65-year-old purchasing an immediate annuity today might receive 20-30% higher monthly payments compared to similar purchases made in 2020-2021.

Market Timing Considerations

While timing the market is notoriously difficult, the current environment presents several warning signs that suggest defensive positioning may be prudent:

- Valuations at historic extremes

- Technical indicators suggesting potential correction

- Economic uncertainties including inflation and geopolitical risks

- Demographic shifts as baby boomers retire en masse

Tax Advantages

Annuities offer tax-deferred growth, meaning you don’t pay taxes on gains until you withdraw funds. In a high-tax environment, this deferral can significantly enhance long-term returns. Additionally, annuities can provide tax diversification in retirement, offering options for managing tax brackets and minimizing overall tax burden.

Strategic Annuity Allocation for Different Retirement Scenarios

The Conservative Retiree (Ages 65-75)

For retirees who prioritize capital preservation and steady income:

- 40-60% in immediate or deferred income annuities for guaranteed income

- 20-30% in fixed indexed annuities for inflation protection with downside protection

- 10-20% in conservative investments for liquidity needs

This allocation ensures that essential expenses are covered by guaranteed income while still providing some growth potential and liquidity.

The Balanced Pre-Retiree (Ages 55-65)

For those approaching retirement who want growth potential with protection:

- 20-30% in fixed indexed annuities for protected growth

- 10-20% in deferred income annuities to create future income streams

- 50-60% in diversified investments for continued growth potential

This approach provides downside protection for a significant portion of assets while maintaining growth potential during the final accumulation years.

The Growth-Oriented Retiree (Ages 60-70)

For retirees comfortable with some risk but wanting protection against catastrophic losses:

- 20-30% in variable annuities with guaranteed living benefits for upside potential with downside protection

- 15-25% in fixed indexed annuities for stable growth

- 50-60% in growth investments for inflation protection and legacy building

Addressing Common Annuity Concerns

“Annuities Are Too Expensive”

While annuities do carry fees, these costs must be evaluated against the value provided. Consider that the “cost” of not having downside protection could be 30-50% of your portfolio value during a market crash. For many retirees, paying 1-2% annually in fees to avoid potential 30-50% losses represents excellent value.

“I’ll Lose Liquidity”

Modern annuities offer much more flexibility than their predecessors. Many products allow:

- Annual penalty-free withdrawals of 5-10%

- Liquidity provisions for nursing home care or terminal illness

- Partial surrenders with proportional penalty reductions

- Return of premium options for beneficiaries

“I’ll Miss Out on Market Gains”

Fixed indexed annuities and variable annuities with guaranteed benefits allow for market participation while providing downside protection. While you may not capture 100% of market gains, you also won’t experience market losses – a trade-off that becomes increasingly attractive as you approach or enter retirement.

The Behavioral Benefits of Annuities

Beyond the mathematical advantages, annuities provide crucial behavioral benefits:

Reduced Anxiety

Knowing that a portion of your retirement income is guaranteed regardless of market performance can significantly reduce stress and anxiety. This peace of mind often translates to better decision-making in other areas of your financial life.

Spending Confidence

Retirees with guaranteed income streams tend to spend more confidently, leading to higher retirement satisfaction. Without the fear of running out of money, retirees can enjoy their golden years rather than constantly worrying about market volatility.

Legacy Protection

By using annuities to cover essential expenses, retirees can afford to take more risk with other investments intended for legacy purposes, potentially leading to better overall outcomes for both the retiree and their heirs.

Implementation Strategies in the Current Environment

Dollar-Cost Averaging into Annuities

Rather than making a lump-sum annuity purchase, consider dollar-cost averaging over 12-24 months. This approach can help smooth out any timing issues and may capture improving rates if interest rates continue to rise.

Laddering Strategies

Consider purchasing multiple smaller annuities over time rather than one large contract. This “laddering” approach provides flexibility and may allow you to benefit from improving terms over time.

Hybrid Approaches

Many investors benefit from combining different types of annuities:

- Immediate annuities for current income needs

- Deferred annuities for future income requirements

- Fixed indexed annuities for growth with protection

Selecting the Right Annuity Provider

In the current environment, carrier selection is crucial:

Financial Strength Ratings

Only consider annuities from companies with strong financial ratings (A+ or better from multiple rating agencies). The guarantees are only as strong as the company providing them.

Product Features

Look for products offering:

- Competitive crediting rates or caps

- Reasonable fees and surrender charges

- Flexible withdrawal options

- Strong guarantees

Professional Guidance

Work with experienced professionals who can help navigate the complex annuity landscape and ensure products align with your specific needs and circumstances.

The Cost of Inaction

While annuities aren’t appropriate for everyone, the current market environment makes them worthy of serious consideration. The potential cost of inaction – remaining fully exposed to market risk when warning signs are flashing – could be devastating for retirement security.

Consider that during the 2000-2002 bear market, the S&P 500 fell 49%. An investor with $1 million in stock market investments would have seen their portfolio drop to $510,000. Even if markets recovered to previous highs over the following years, the sequence of returns risk could have permanently impaired their retirement security if they were taking withdrawals during the downturn.

In contrast, an investor who had allocated 40% of their portfolio to annuities would have maintained $400,000 in protected assets, significantly reducing the impact of the market decline on their overall financial security.

Conclusion: Building a Resilient Retirement Strategy

The crossing of the “line of death” serves as a stark reminder that market euphoria often precedes significant corrections. For retirees and pre-retirees, the current environment demands a defensive approach that prioritizes capital preservation while still allowing for reasonable growth.

Annuities, despite their complexity and sometimes negative reputation, offer unique benefits that are particularly valuable in today’s market environment:

- Principal protection against market downturns

- Guaranteed income streams for life

- Tax-deferred growth potential

- Behavioral benefits that enhance retirement satisfaction

The key is not to view annuities as an all-or-nothing proposition, but rather as one component of a diversified retirement strategy. By allocating a portion of retirement assets to annuities, investors can create a foundation of guaranteed income and principal protection that allows them to take appropriate risks with their remaining assets.

As market warning signs continue to flash, the question isn’t whether you can afford to invest in annuities – it’s whether you can afford not to. The peace of mind and financial security that comes from knowing a portion of your retirement is protected from market volatility may prove invaluable in the challenging times ahead.

The time to act is now, before the next market correction tests the resilience of your retirement strategy. By incorporating annuities into your retirement planning today, you can sleep soundly knowing that regardless of what the markets bring, your essential retirement needs are secure

0 Comments